Electrifying Deutschland: The Bestselling EVs in Germany, 2025

Germany’s EV market is humming. In Q1 2025, electric vehicles took 27.1% of new car sales, up from 23.4% in Q4—BEVs alone accounted for 18.5% of that total. That’s massive, considering subsidy cuts and economic uncertainty. But what’s really fueling this momentum? Let’s unpack the top-selling EVs in Germany, model by model, and explore what they say about the country’s shift toward green driving.

1. Volkswagen ID.7 – The Executive Reimagined

Big, sleek, and European through and through. The ID.7—a four‑door liftback—is outselling every other EV model for four months running, with 3,133 registrations in April alone.

This isn’t a tech-gadget car; it’s the perfect blend of understated luxury and efficiency. Think aerodynamic polish, roomy interior, and a whisper-quiet drive that says “corporate class” without shouting it. German execs want comfort; this gives them comfort—with zero emissions.

2. Volkswagen ID.3 – The Compact Powerhouse

Following right behind is the ID.3 with 2,989 units in April—its highest monthly tally in 10 months.

At ~€30k for the Pure version, it’s the EV equivalent of a reliable Swiss Army knife—compact, versatile, and packed with essentials. Ideal for city driving, weekend escapes, and highway hops. Its resurgence shows German buyers crave affordability and the EV experience.

3. Volkswagen ID.4/ID.5 – The Homegrown Crossover Duo

The ID.4 and its coupe-style twin ID.5 sold 2,629 units together in April, taking third place.

Here’s a thought: Germans love crossovers, but they also love German engineering. These models deliver room, performance, and that classic VW refinement—mixed with efficient MEB underpinnings. They’re that dependable friend who shows up with coffee. Functional, comfortable, and never flashy.

4. Tesla Model Y – The Waiting Game Continues

Quick story: Tesla halted Model Y production in early 2025 for an 11-week factory retool. Despite that, the Model Y remains the top individual BEV for 2024 .

That means demand is strong—even if supply’s paused. Once production ramps, expect the Model Y back in top contention. It’s lightweight, fast, and stands out… though German buyers increasingly weigh national pride and company loyalty.

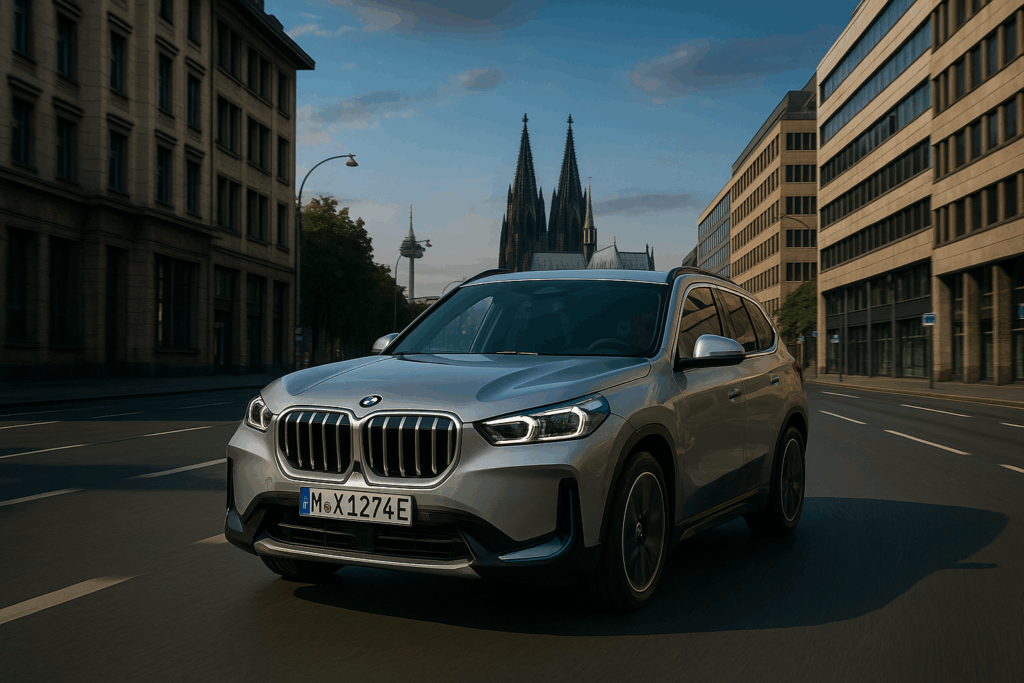

5. BMW iX1 – The Luxury Micro‑SUV

BMW’s iX1 creeps into the chart at 7th place, the only non-VW model in the top rankings.

This small luxury SUV makes perfect sense. German buyers want prestige—even for everyday errands. The iX1 delivers with coded sophistication, BMW dynamics, and a premium cabin. It’s quiet flex that says, “I care.” And it shows luxury EVs still have a firm foothold.

6. Renault Zoe, Skoda Enyaq, Hyundai Kona & Fiat 500e – The Familiar Favorites

Peeking deeper into Germany’s EV tapestry, the Zoe, Enyaq, Kona, and 500e all remain popular thanks to long-term presence—some have been around since 2015–16.

These aren’t headline-makers, but they tell us something: model maturity matters. Established nameplates with proven reliability and service networks keep finding buyers. Sometimes slow and steady really does win.

🚥 What This Lineup Reveals

🇩🇪 German Brands Foundational, but Choice Expands

Volkswagen dominates the leaderboard—understandably, given its lineup breadth and domestic preferences. But the presence of BMW and Tesla proves Germany’s open audience: homegrown heroes and global disruptors coexist.

🏙️ Buyers Want Versatility

From executive sedans (ID.7) to compact champions (ID.3) and luxury micro-SUVs (iX1), Germans are buying EVs for all parts of life—from autobahn commuting to tight urban streets.

🤔 Production Pauses Matter

Tesla’s pause shows how supply chain and factory tweaks ripple in the charts. Losing 11 weeks of output means fewer sales, even when demand is solid.

📈 Market Stabilization Post-Subsidy

Despite cuts to subsidies, EV sales rose—Q1 BEV share jumped from 15.8% to 18.5% quarter-over-quarter. That’s government support only one part of the equation. Convenience, tech, and price are stepping up.

The Market’s Driving Forces

1. Corporate Fleets & Tax Benefits

German corporations are swapping combustion fleets for EVs—partly due to tax perks. These fleet orders supported Q1 stability, even as consumer sentiment wavered .

2. Charging Infrastructure

Public charging has grown significantly. It’s smoother to own an EV now than ever—thanks to better networks and ease of access.

3. Model Refresh Waves

VW’s prepping ID2 and ID1 for 2026 and 2027—sub-€25k models designed to widen appeal and margin. That’s critical: pricing power will define next-gen uptake.

4. Policy & Regulation

EU emissions rules, tariff chatter, and shifting subsidies create a backdrop of uncertainty. But clear direction on EV policy helps buyers feel more confident.

🚀 What’s Around the Bend

- New model launches: VW’s compact ID2/ID1, Audi Q4 e-tron upgrades, BMW i5—all poised to reset expectations.

- Tesla ramp-up: Once Model Y production restarts big, Germany may shift again.

- Chinese challengers: BYD’s pushing PHEVs and pure EVs—plans include more hybrids in German showrooms.

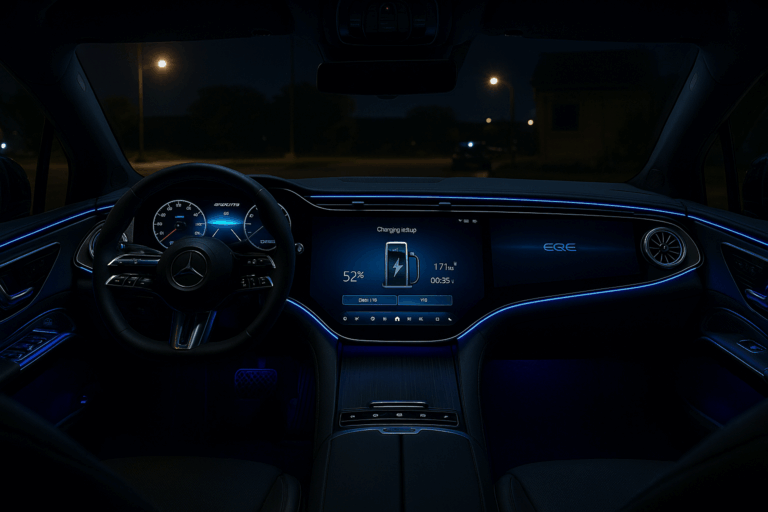

- Luxury EV growth: Brands like Mercedes, Porsche, Audi double down on premium electrics—expect more chart entries.

✨ Final Spark: Germany’s EV Dance

The numbers tell a story of balance. A strong domestic lineup—VW leading the charge—but openness to global tech and luxury innovation. Buyers want pragmatism and prestige, not gimmicks. They want cars that fit into daily life and future visions.

When a sleek ID.7 glides past you on the autobahn, or a zippy ID.3 hums past city buses, remember: you’re seeing a revolution built on tradition, but pointing firmly forward.